Start Investing Early and Watch your Wealth Grow!

A recent study showed that many Canadians may need to save as much as $1.7 million* to retire comfortably. The good news is that consistently saving and investing even small amounts while you are younger can grow your retirement savings faster than you realize!

Benefits of Investing Early

Compound Interest

Long-Term Growth

Flexibility

Financial Security

Learning Opportunities

Comfortable Retirement

Why Invest Early?

Investing at a young age is one of the most powerful ways to build wealth and secure your financial future. When you start investing in your 20s and 30s, you give your money more time to grow through the magic of compound interest. This means that even small, consistent investments can turn into substantial wealth over time.

The Power of Compound Interest

Compound interest allows your money to earn interest on both your initial deposit and your accumulated interest. Think of it as earning interest on your interest. The earlier you start investing, the more time your money has to compound, resulting in significant growth.

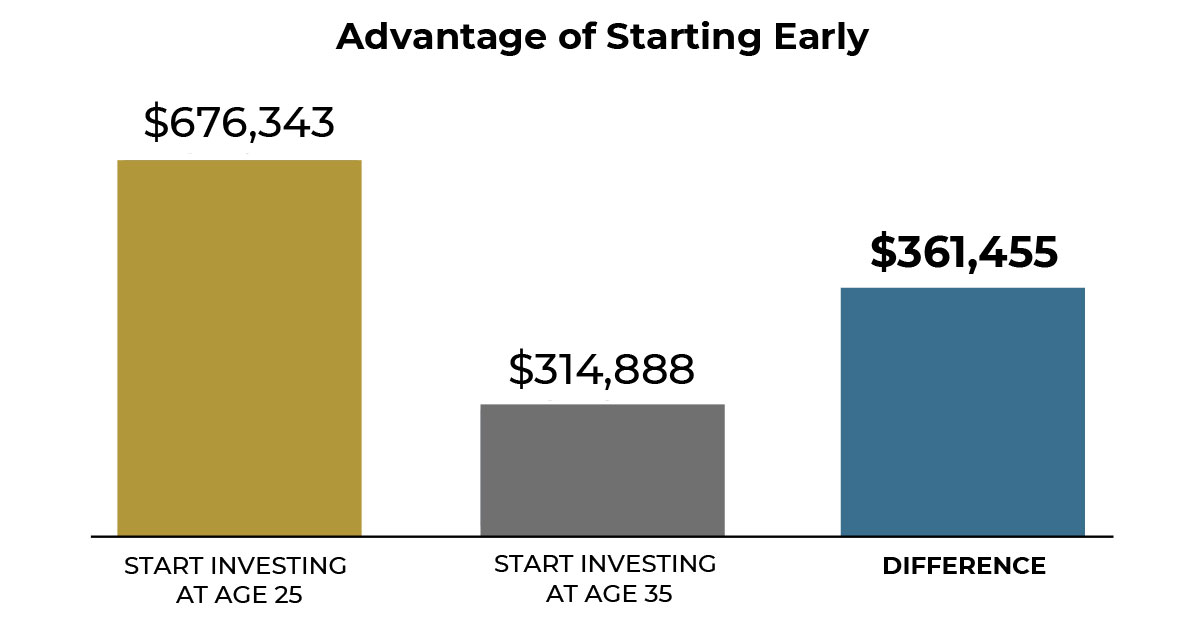

Let’s See an Example: $250 to $675,000

By investing $250 monthly starting at age 25, with an average annual return of 7%, by the time you reach 65, your investment would be worth approximately $675,000. If you wait until age 35 to start investing, under the same conditions**, you would only have around $315,000 by retirement. The earlier you start, the more significant the growth.

**Calculations based on an $1,000 initial RRSP investment with a $250 a month contribution for the terms of 30 and 40 years of growth time, while assuming a 7.00% rate of return.

Set It and Forget It: the PAC

Want an easy approach to small, consistent investing? Try a pre-authorized contribution (PAC) plan. You can automatically invest money weekly, bi-weekly, or monthly before you spend it on anything else. It’s like paying yourself first and you’ll be surprised how much and how quickly your savings add up!

Options to suit your needs

We offer a variety of investment options to suit your needs.

How Much Do You Need to Retire?

What will your retirement look like? To begin, it's important to understand your goals and how to plan for them. Planning helps determine how much you’ll need and is dependent on things like your income, lifestyle, health, and retirement expectations. According to the Government of Canada, a general rule of thumb is to save and invest for about 60 to 70% of your current income.

Try our suite of retirement calculators to help you see what your retirement dreams might need and also talk to us – we can help get you started.

Get Started Today!

Investing young is one of the smartest financial moves you can make. Remember, every small step you take today brings you closer to financial freedom and a comfortable retirement. Start investing now and watch your wealth grow!

Assumptions:

Investment growth is tax-deferred. For monthly investments, the rate of return is compounded monthly.

Disclaimer:

This calculator is for educational purposes only. All charts and illustrations are for illustrative purposes only and are not intended to illustrate the performance of any security or portfolio. You should not rely on the results as an indication of your financial needs and we recommend that you seek your own financial, investment, tax, legal or accounting advice nor shall the information herein be considered as investment advice or as a recommendation to enter into any transaction. Professional advice should be obtained prior to acting on the basis of this information. The deduction of advisory fees, brokerage or other commissions and any other expenses that would have been paid may not be reflected in the calculation results. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus and/or Fund Facts before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated. >©Copyright 2024 Ativa Interactive Corp. All rights reserved. Powered by Ativa.com.

Source:

*Statistics Canada – Canadian Income Survey, 2021: https://www.qtrade.ca/en/investor/campaign/brand.html