Retire with debt? Whoever heard of such a thing? We all know that nobody should ever retire with debt. Or do we?

Conventional wisdom would tell you, "No, of course, you shouldn't retire with debt." But the answer isn't that simple. As with most wealth management and investment strategies, every situation is different.

The fact is, sometimes debt is unavoidable and sometimes even advantageous. Let’s look at some facts and examples regarding debt during retirement and share ideas and tips to help you think about your own situation.

And remember – you should talk to a professional wealth advisor about retirement planning and debt during retirement.

Good Debt vs. Bad Debt

What's the difference between good debt and bad debt? Generally speaking, good debt shouldn't reduce your nest egg or compromise your monthly budget.

So, high-interest credit cards? Bad debt. You're throwing money away on interest. Buying an expensive toy that forces you to use money now that you may need in the future? Bad debt. If you can't afford that new toy by using your savings, don't let attractive monthly payments lure you into a bad decision.

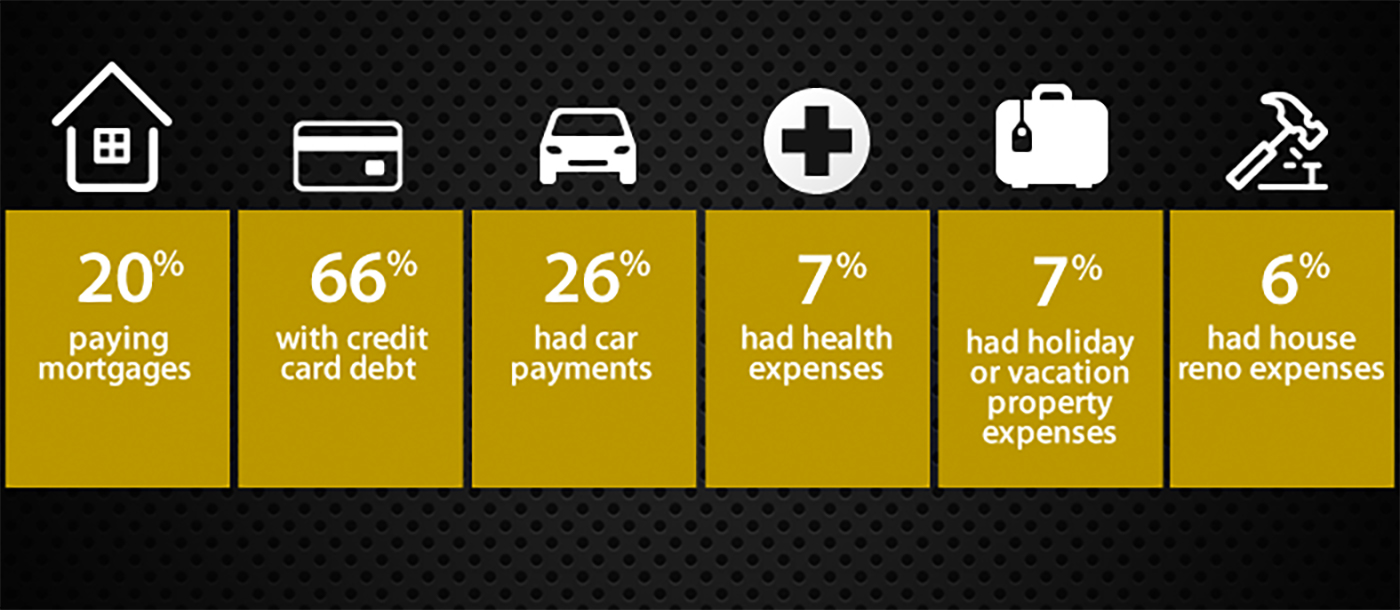

According to a 2017 Ipsos survey, 20% of Canadian retirees were still paying mortgages and 66% were carrying credit card debt. In fact:

- 26% were making car payments

- 7% had unpaid health expenses

- 7% owed money on holiday expenses or vacation property

- 6% hadn't paid off home renovations

Good debt can be described as manageable within your means and carries with it low-interest rates. Ideally, the debt should help increase the value of your assets at a lower rate than your current assets generate. Here's an example of what we consider good debt.

Bill and Susan have an 8-year old vehicle that requires a major scheduled service appointment. It also needs new tires and a few minor repairs.

They noticed an ad for a new model that is smaller, better on gas and a better fit for their current lifestyle. When they compare the money they'll spend on payments, maintenance and gas over the next 10 years between the two vehicles, the new vehicle will cost almost the same as the old vehicle.

They met with their Innovation Wealth Advisor to discuss their options. She suggested that they could save some money by using a Home Equity Line of Credit (HELOC) instead of the dealership financing. In the end, Bill and Susan bought the new vehicle that was a better fit for their needs using a HELOC, the monthly payments easily fit into their monthly budget AND they didn't have to pull money from their savings.

How much debt can you manage?

This is more a technical question than a philosophical or emotional one, and one that you should really discuss with your wealth advisor. There are several tax and timing details that a wealth advisor can help you understand.

In simple terms, we help you look at your assets versus your liabilities plus your cash flow and ensure you can handle any debt you are considering.

We begin with a simple net worth statement, listing your liabilities and your assets. This will help put your total debt in perspective. Do you have a high debt-to-assets ratio? This might be a red flag as you approach retirement.

Next, we help you estimate your monthly retirement income and expenses by adding up your expected income from all sources, subtracting your estimated expenses, and factor in recurring expenses such as taxes and insurance.

Ideally, you should have enough retirement income to cover your expenses and debt payments without depleting your assets. If you have enough retirement savings, as well as other sources of retirement income that will cover your expenses including debt, then paying off a mortgage may not be an issue.

Will You Sleep at Night if you Retire with Debt?

Financial spreadsheets, cash flow analysis, and detailed financial planning are incredibly important to help determine how much if any debt you should have during retirement but there is another important factor that may be harder to answer. What are you comfortable with?

Does debt stress you out? Will debt make you feel like you didn’t achieve your retirement goals?

It’s your money and your life. Your emotions do play an important role. It’s very important to honestly assess your “comfort zone” in your financial plans.

As suggested near the beginning of this article, you should work with a wealth professional to help build a financial plan for your individual situation. Contact one of our Wealth Management professionals to help you get started.